Autumn Budget missed vital opportunity to revitalise housing sector, Propertymark argues

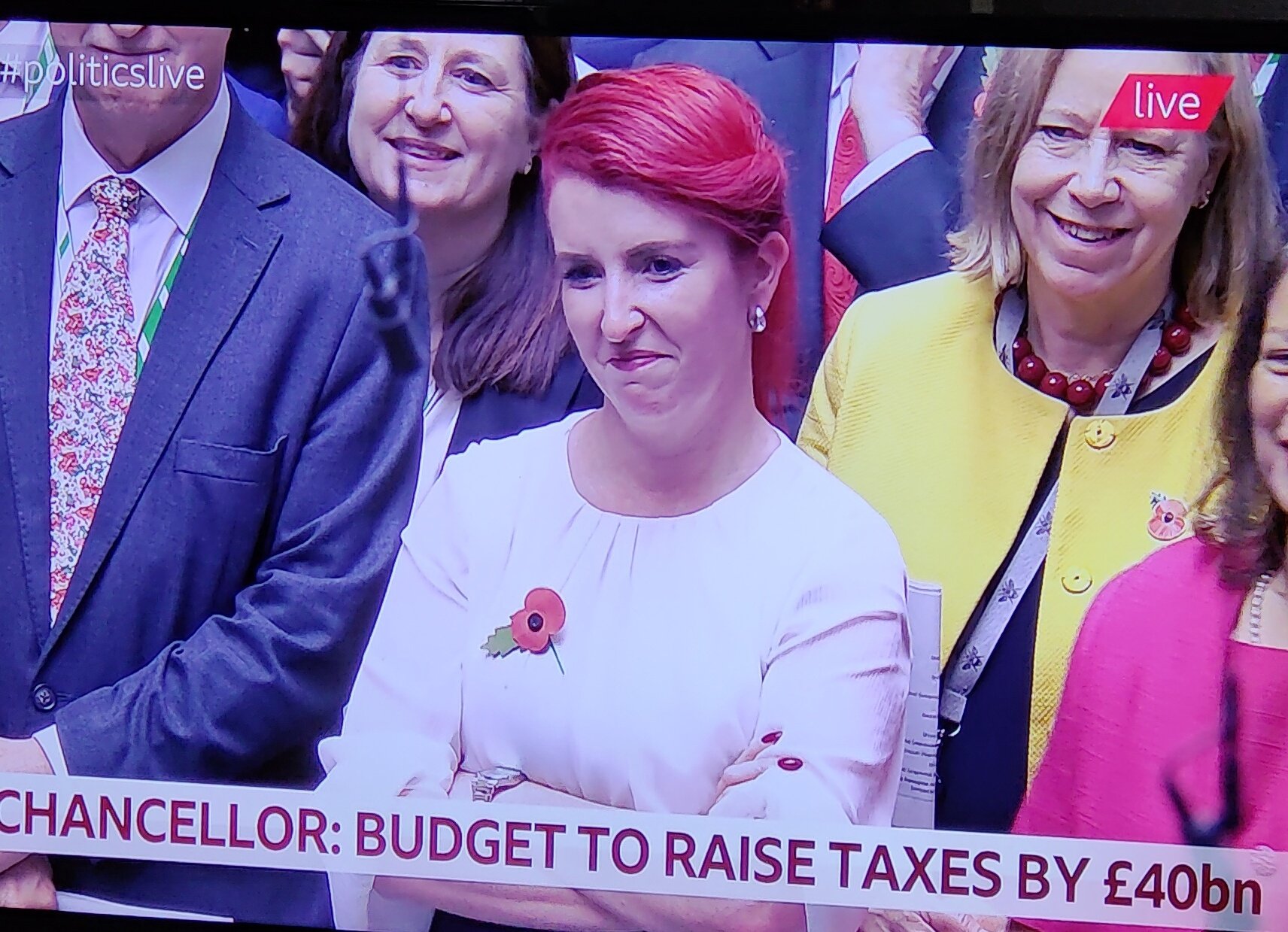

Propertymark has argued that the Autumn Budget, announced by Chancellor Rachel Reeves on 30 October, was a missed opportunity to reform and address concerns across both the private rented and sales sectors.

Reeves said she must raise £40 billion in taxes to cover the UK Government’s £22 billion ‘black hole’ that she claimed she inherited from the last government.

There will be a two per cent increase on the Higher Rates for Additional Dwellings on second homes or buy-to-let residential properties, which will now go up to five per cent from 31 October 2024. Prior to the Budget, Propertymark suggested that the three per cent SDLT surcharge on second homes and buy-to-let properties should be revised as it deters likely rental property investors, thereby worsening the housing supply shortage, and instead promoted targeted tax reliefs to mitigate this effect.

Although the threshold for first-time buyers was not reduced by Ms Reeves from £425,000 to £300,000 as reported on prior to the Autumn Budget, there were no measures to reform Stamp Duty and persuade buyers to make their next purchase.

Prior to the Budget, Propertymark called for more help for last-time buyers aged 55 or over who are considering ‘right sizing’ by relocating to a smaller property, and for the zero rate of Stamp Duty to remain for first-time buyers purchasing properties worth up to £425,000.

Furthermore, the Chancellor has increased the lower rate of Capital Gains Tax from 10 per cent to 18 per cent, and the higher rate from 20 per cent to 24 per cent. However, the CPA on residential property will remain at 18 per cent and 24 per cent respectively.

Propertymark stated prior to the Budget that the Chancellor should have contemplated increasing the tax on profits made on the sale of buy to let properties to achieve parity with the higher rate of 24 per cent, regardless of a landlord’s income bracket, to prevent landlords from exiting the market in droves.

Another tax measure the Budget included was an extension to the inheritance tax threshold until 2030 instead of 2028. This will result in the first £325,000 of any estate being inherited tax-free. This will increase to £500,000 if the estate consists of a residence passed to direct descendants, and £1 million when a tax-free allowance is passed to a surviving spouse or civil partner.

Propertymark argued for revisiting inheritance tax thresholds, which have not changed since 2009. The professional body said that the £325,000 threshold no longer aligns with inflation and property price increases, ending up with more property owners paying the tax.

Reeves has committed to investing £5 billion to deliver the UK Government’s housing plan.

Regarding social housing, other policies that the Budget contained included boosting the Affordable Homes Programme to £3.1 billion, as well as a commitment to renovate sites like Liverpool Central Docks with 2,000 homes, and money for Cambridge to ‘realise its full growth potential’.

£128 million will be invested to launch new housing developments across the nation, such as beating river pollution that is currently stopping the construction of up to 28,000 new homes and investment in 3,000 energy-efficient properties nationwide.

Right to Buy discounts will be cut so that local councils can keep receipts from any social house sales and reinvest that money into increasing housing supply.

There will also be a social housing rent settlement of CPI plus 1 per cent for the next five years.

Also, £1 billion will be invested to remove dangerous cladding on homes following the Grenfell Report. Propertymark has previously called for action to be taken against dangerous cladding following the Grenfell Inquiry.

The Chancellor has also declared that the existing 75 per cent discount to business rates – which should have stopped in April 2025 – will be replaced by a discount of 40 per cent, which results in a discount of £110,000. This will result in business rates doubling as opposed to quadrupling.

This measure could impact commercial agents and landlords, possibly needing amendments to rental agreements and property valuations.

Another measure that could affect property agents include the National Living Wage for people aged 21 or older surging by 6.7 per cent from £11.44 an hour to £12.21 from next April.

Also, the National Minimum Wage will be boosted for people aged between 18- and 20-years old from £8.60 to £10.

Apprentices will gain the largest pay rise, with hourly pay being boosted from £6.40 to £7.55.

Finally, Ms Reeves increased employer contributions to national insurance by roughly 1.2 percentage points to 15 per cent from April 2025. The threshold at which they start paying this tax will also decrease from £9,100 to £5,000.

However, the Employment Allowance will rise from £5,000 to £10,500 and the £100,000 threshold will be removed in a move to assist small businesses with claiming back from their bill. Therefore, this means that 865,000 employers will pay no NICs next year, and a further 1 million will pay the same as they did previously.

Propertymark was disappointed that the Budget contained no measures to help landlords such as restoring mortgage tax relief, and grants and loans to help them meet the Minimum Energy Efficiency Standards (MEES).

The professional body wanted Ms Reeves to end Section 24 of the Finance Act, which used to enable landlords to claim 100 per cent of their mortgage interest when finishing their tax returns. Costs for landlords have increased and deterred them from joining the market since the policy was implemented in 2015. Propertymark’s report Impact of Section 24 on buy-to-let landlords in England found that 69 per cent of landlords surveyed at the time had witnessed a surge in their monthly mortgage repayment.

They also urged the UK Government to help landlords and homeowners with their energy efficiency goals via a combination of grants, loans, and assistance with survey costs, all of which should further persuade them to hit the MEES targets.

Nathan Emerson, CEO at Propertymark, said:

“Whilst it is understandable that the UK Government needs to find more revenue, the increase in the Stamp Duty surcharge for second homes will not help increase demand for rented property at a time where homes are desperately needed to compete with ever-growing demand from tenants.

“Considering this Government is committed to Net Zero, it is going to be hard for landlords and homeowners to meet the UK Government’s MEES targets without help via loans and grants.

“Furthermore, the hike in national insurance contributions could hit many property agents who are trying to ensure that they are maintaining a steady cash flow while paying their employees a decent wage.

“However, it is encouraging to see that the UK Government is investing money to end dangerous cladding following the Grenfell Inquiry, something Propertymark welcomes. We look forward to continuing working with the UK Government as they move these plans forward.”