One in Five People Are Borrowing More When They Remortgage For Debt Consolidation

According to the Office for National Statistics, more than a fifth of British people have borrowed more money as a result of the cost of living crisis[1], and the number of homeowners planning to release equity for debt consolidation is expected to rise.

To investigate further, Uswitch.com remortgage experts surveyed 1,000 Brits who are planning to remortgage within the next year to find out why people are remortgaging, if they intend to borrow more money when they remortgage, and what they would like to borrow more money for.

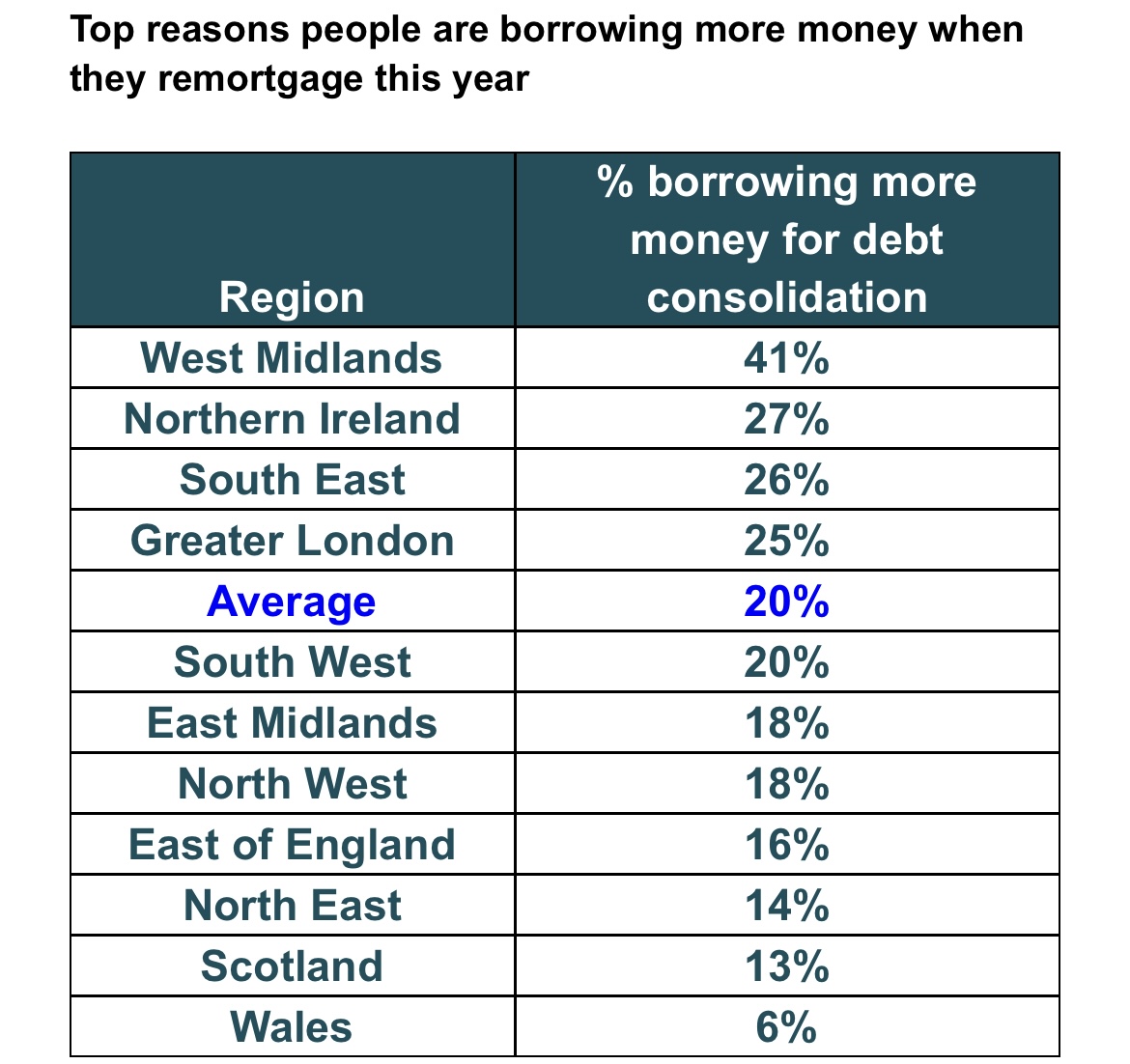

One in five (22%) people are borrowing more for debt consolidation, but this number increases to 41% in the West Midlands, where people are most likely to need the money for debt consolidation.

Well over a third (39%) of people are planning to borrow more money when they remortgage. The over 55s are the most likely to borrow more money when they remortgage (53%).

Over 60% of those who are borrowing more money when they remortgage are concerned about the financial implications, their overall debt, and falling into negative equity but are still planning to borrow more money.

More than a third (36%) of homeowners who are remortgaging within the next year are planning to switch providers, although half are planning to stick with their current provider.

How has the cost of living crisis affected people’s decisions to remortgage?

Almost half (46%) of homeowners say the cost of living crisis has made them want to remortgage early, and a further 39% said the crisis has made them want to shorten their term when they remortgage.

One in five (20%) of those due to remortgage within the next year say the cost of living crisis has decreased how much they can borrow.

More than a third (39%) of mortgage holders said the current cost of living crisis has meant they need extra cash, with this rising to almost 50% for the over 55s.

How much are people paying for their mortgages currently?

The majority of homeowners are paying between £700- £1,000 for their monthly mortgage payments, but one in ten (11%) are paying more than £1,000 each month for their mortgage. The average monthly mortgage payment in the UK is £932.

Interestingly, the over 55s pay the most for their mortgage payments (an average of £1,363 a month), and the 35-44 year olds pay the least, paying £530 a month less than the over 55s.

Homeowners pay the most in the South West for their monthly mortgage payments (£1,249), and homeowners in Northern Ireland pay the least (£762).

How much do people want to borrow?

Half (46%) of the homeowners due to remortgage are looking to borrow more than £50,000, with the 25’s to 34s plan to borrow the most with an average of £53,616.

Londoners plan to borrow the least (£42,573), and homeowners in the South West plan to borrow the most (£55,001).

Kellie Steed, Uswitch.com remortgages expert, has provided these tips for those looking to borrow more money when they remortgage this year:

“The cost of living crisis has increased the amount of debt people are taking on, and our research has shown that more than one in three homeowners are planning to borrow more money when they remortgage this year.

“If you’ve built up equity in your home, releasing some of it by remortgaging might be the most practical and cost-effective way to pay off debts. Especially, if you have debts with hefty interest rates, however approach this way of borrowing with caution.

“When releasing equity, keep in mind that this will increase the loan-to-value of your borrowing, which may limit your access to the lowest rate mortgage products. It’s also important to remember that although you may pay less each month, your debt will likely cost you more to repay over the course of the mortgage, as mortgage terms are typically longer than for any other form of borrowing.”