Vietnam life insurance industry to reach $17 billion by 2026, driven by economic recovery and endowment insurance demand, forecasts GlobalData

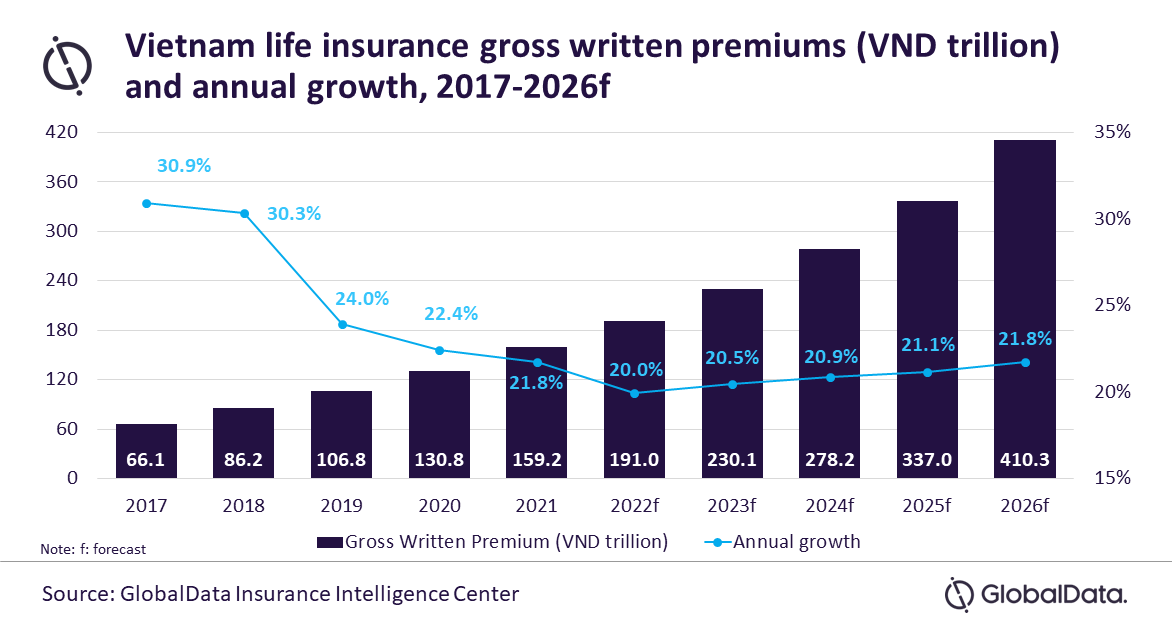

The life insurance industry in Vietnam is set to grow at a compound annual growth rate (CAGR) of 20.8% from VND159.2 trillion ($6.9 billion) in 2021 to VND410.3 trillion ($17 billion) in 2026 in terms of gross written premium (GWP), forecasts GlobalData, a leading data and analytics company.

According to GlobalData’s Insurance database, the Vietnamese insurance industry is projected to grow by 20% in 2022 and 20.5% in 2023, driven by economic recovery and growing demand for endowment policies that offer an attractive return on investments.

Sutirtha Dutta, Senior Insurance Analyst at GlobalData, comments: “Vietnam’s life insurance segment growth is also supported by stable business environment that has resulted in an increase in per capita income by 9.5% in 2022 as compared to the previous year. Political stability and extensive free trade agreements have encouraged many multinational companies to shift their production units to Vietnam. This helped increase employment rate and household disposable income which has supported life insurance growth.”

Endowment insurance is the most popular product in Vietnam, accounting for an estimated 88% of GWP in 2022. Rising disposable income and limited savings options due to lower interest rates make endowment life insurance attractive, as it offers higher returns. Endowment insurance is expected to remain popular and grow at a CAGR of 15.4% during 2021-2026.

Sutirtha adds: “Moreover, increased awareness about financial planning following the pandemic along with a variety of benefits offered on purchase of endowment insurance has supported its demand.”

Term life insurance accounted for an estimated 1% of GWP in 2022, while whole life, general annuity, pension, and personal accident and health insurance accounted for another 1% share of GWP in 2022. Including supplementary or riders purchased insurance, all these insurance products accounted for 10% of GWP in the year.

Sutirtha continues: “Personal accident, critical illness, disability, and health policies are added as riders to the universal life and endowment policies, thereby making them attractive products. Additionally, they help increase health coverage at a relatively lower premium making these riders popular in Vietnam.”

The demographic pattern of Vietnam shows that the country’s population is aging at a faster pace and at an early level of economic development as compared to other countries. There has been a decline in the working-age population. This is expected to increase the number of dependents on the working population and will support uptake of supplementary insurance. Supplementary or riders insurance is forecast to grow at a CAGR of 17.3% during 2021-2026.

Sutirtha concludes: “Vietnam is projected to become an aged society by 2035 which will create demand for life insurance. A stable business environment and rising household income will also aid in the growth of the life insurance industry during the forecast period.”