Tim Chong CEO of Yonder comments on importance of financial literacy for young people

As the year begins and the UK heads into a further period of prolonged economic uncertainty, many Brits will be doing all they can to save money where they can.

For younger people, who are just stepping into the world of work, with no savings and little to no financial education, it will be a challenging time. Prime Minister, Rishi Sunak has just announced that he pledges to make maths a compulsory subject for pupils up until 18, to ensure they are better equipped to enter the real world.

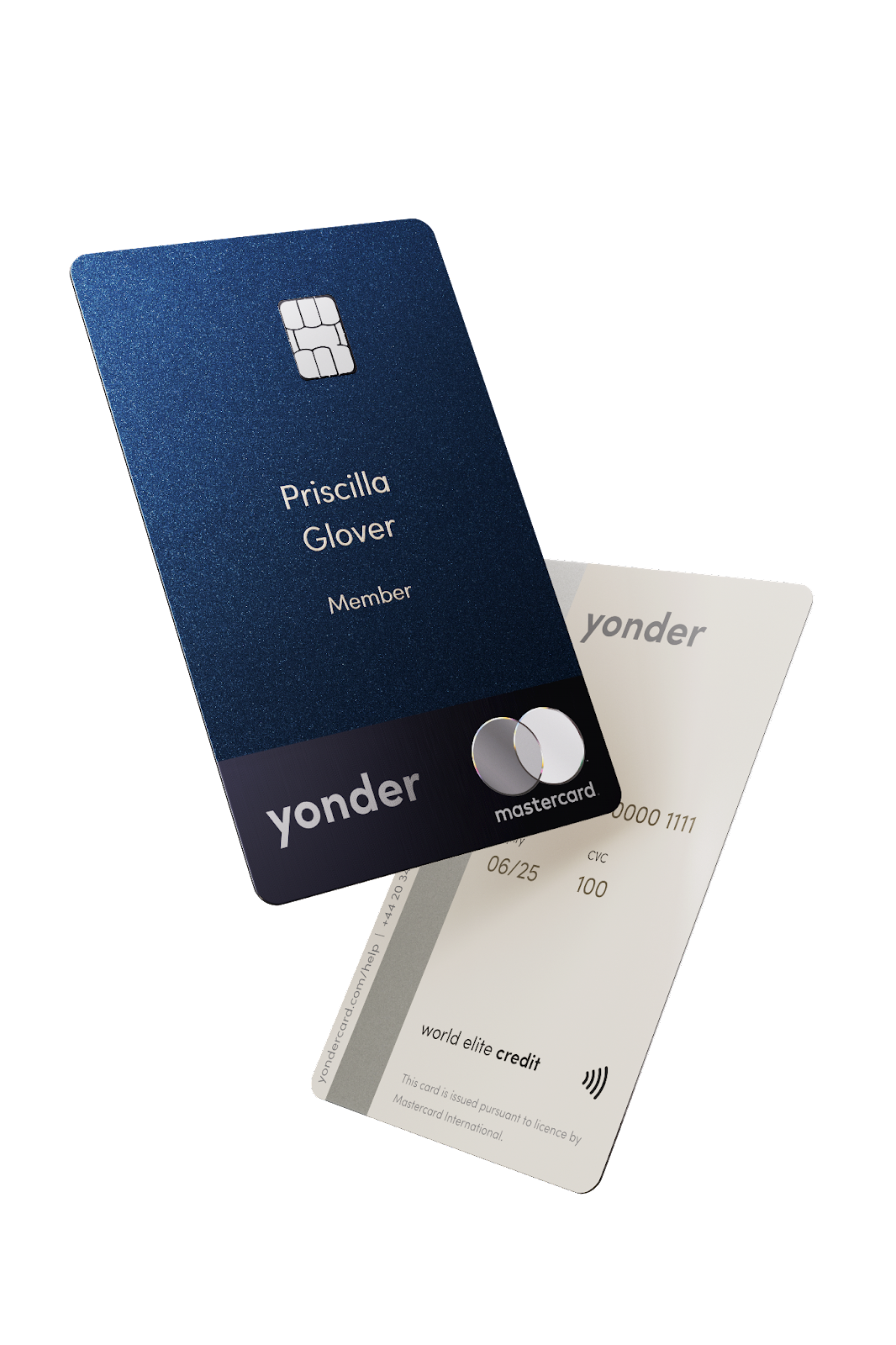

I am getting in touch on behalf of Yonder, the London based reward credit card. The CEO and founder, Tim Chong (ex Clear-Score), believes it is imperative that younger people are not only taught maths and the basics of budgeting, but how their spending habits can have a positive impact on them in the long run.

Historically, younger people have been sworn off credit cards by their parents who believe they will rack up unsustainable amounts of debt. Yonder wants to help educate this generation on the importance of building up their credit score, checking their bank statements, and spending wisely.

CEO and founder of Yonder, Tim Chong comments: “Younger generations have been scared off of credit thanks to predatory lending practices from legacy credit providers, meaning a whole generation of consumers are missing out on the greater benefits of responsible use of credit. Younger people could find it harder to secure mortgages and other credit products in the future if they avoid all credit usage now. Consumers of all ages need to embrace financial literacy to build confidence and understanding with their finances so they can reduce stress and worry over money. The sooner individuals do this, the better equipped they will be to enjoy many of the opportunities that come with having a good financial education.”