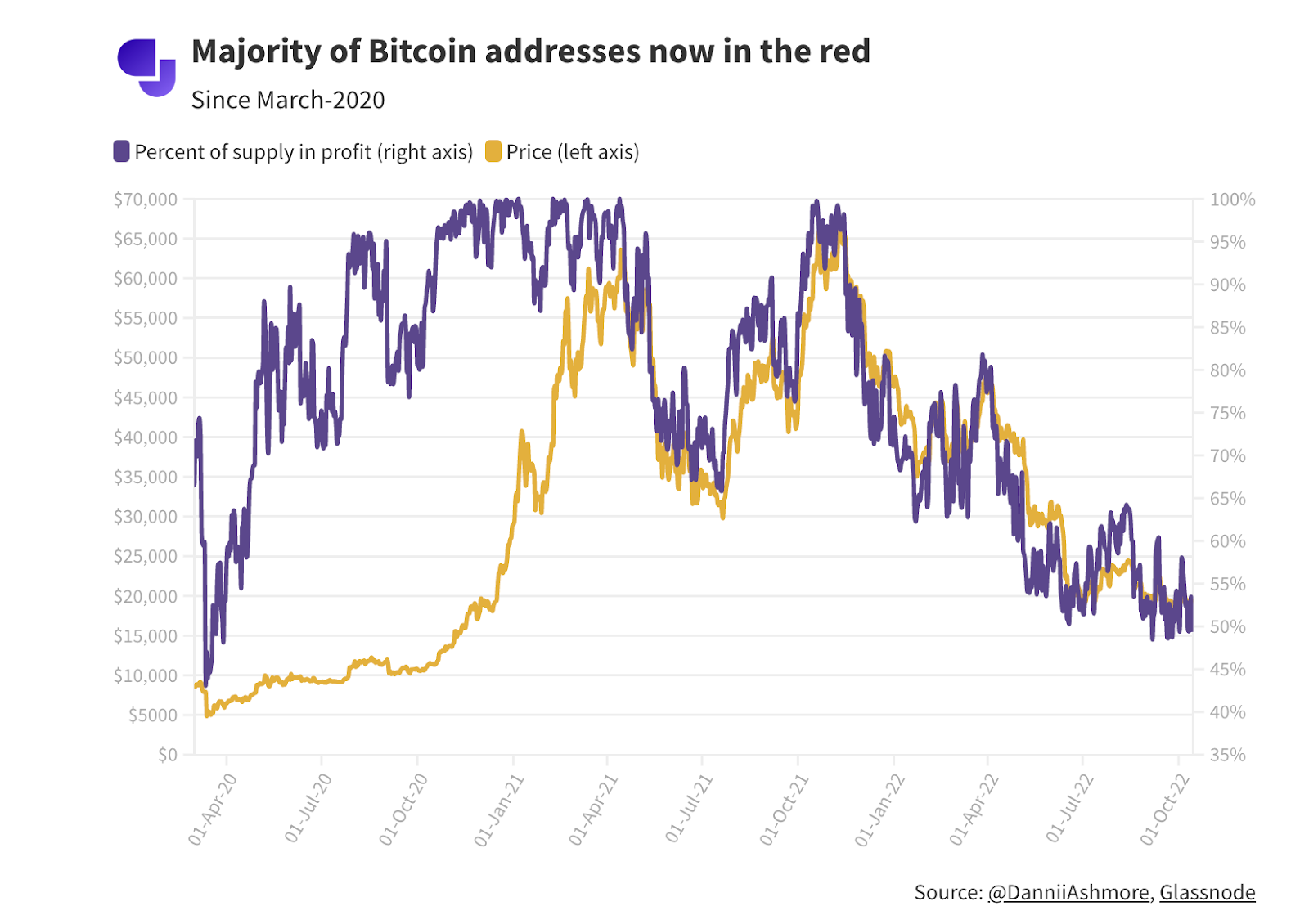

Less than 50% of Bitcoin addresses are profitable

A cryptocurrency analyst has observed that the amount of Bitcoin addresses in profit is now lower than 50% – 49.4% to be precise. But, what does the future have in store for Bitcoin?

Dan Ashmore, Analyst at CoinJournal has commented:

“Bitcoin has been one of the fastest-accelerating asset classes in history. Trading at fractions of a penny 14 years ago, it ran all the way up to close to $69,000 last year. It is against this context of outrageous gains which shows how remarkable it is that most of the Bitcoin supply is now loss-making. Comparing the current price of Bitcoin to the price at which coins within each address last moved, only 49.4% of addresses are in profit.

Aside from a couple of brief visits below 50% in September, this marks the first time since the COVID-panic of March 2020 that the majority of Bitcoin addresses have been in the red.

But what could be the cause of this?

Perhaps there is a lesson in FOMO here somewhere. It is stunning how much money poured into the crypto markets during the pandemic, with cryptocurrency constantly residing in media coverage, Zoom chatrooms, and mainstream consciousness – that the bulk of the network is now underwater.

Zooming out further to Bitcoin’s inception in 2010 shows how the price really ramped up in latter years – as well as the number of addresses in profit plummeting thereafter when the music stopped playing.

This doesn’t really show us anything we don’t know already, but I nonetheless thought it underlined quite how brutal this bear market has been. In looking back at the 2018 bear market, the bottom was hit when the addresses in profit dipped below 40%. In March 2020, although an extreme outlier month given it was when COVID truly arrived, we dipped below 45%.

What does this mean for the future of Bitcoin?

I actually think that metrics from previous crypto winters here are largely irrelevant. Crypto has evolved too much to be compared to those days anymore when liquidity was so scarce and Bitcoin was confined to faraway corners of the Internet. It was not a mainstream financial asset, so I am hesitant to draw too much from studying these time periods.

Secondly, the previous cycles did not occur in conjunction with a bear market across all financial assets. The stock market has printed unstoppable gains since 2009, which was the year Satoshi Nakamoto essentially invented crypto when he published the Bitcoin whitepaper.

Let me be very clear, therefore: crypto has never existed while there has been a wider market bear, or – dare I say it – recession. With that in mind, comparisons to previous cycles need to be made prudently. This is not a case of simply waiting to inevitably bounce back. Maybe that is exactly what will happen. Who knows – but my point is that such blind optimism is misplaced. This is an unprecedented environment for crypto. And more addresses than not being loss-making shows quite how far we have fallen.”