tell.money’s Cutting Edge Dolution Eases Client Journeys Towards Compliance with CoP Specific Directive 17

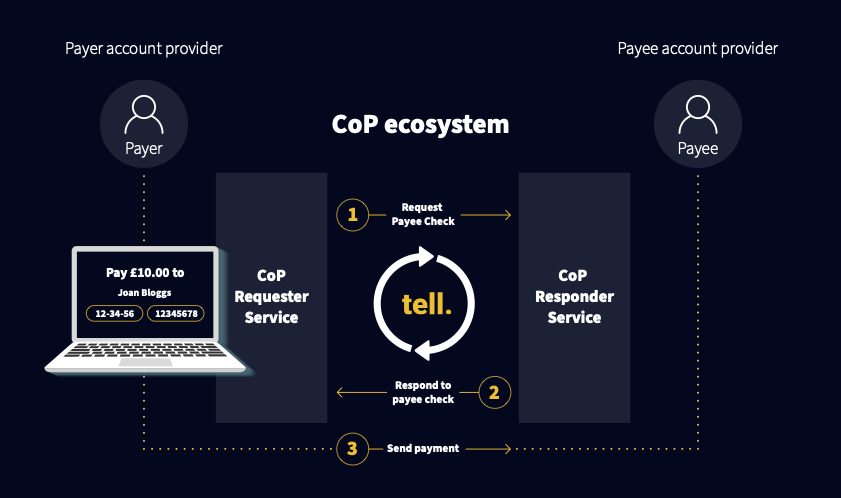

In a world where Authorised Push Payment (APP) scams and misdirected payments are on the rise, tell.money is proud to offer its state-of-the-art solution that enables Payment Service Providers to comply with the Payments System Regulator’s, Specific Direction 17 on expanding the Confirmation of Payee (CoP) system.

CoP has been an invaluable tool for consumers in reducing the risk of fraudulent activities. The figures speak for themselves: according to a report from UK Finance, the rise in fraud has reached catastrophic levels, with losses increasing by a staggering 30%. In a separate report from Finextra, it was found that 69% of businesses have experienced significantly or somewhat higher losses due to fraud in 2023 alone.

Now, under Specific Direction 17, CoP will be a game-changer for businesses. The PSR has directed 400 payment service providers in the UK to implement the CoP name-checking service for their customers. This directive aims to significantly reduce Authorised Push Payment (APP) fraud and the occurrence of misdirected payments. With the deadline for PSPs to become compliant with CoP set for October 31, tell.money is ideally positioned to support firms in meeting this deadline while helping them to reduce the risk of fraud and misdirected payments

David Monty, founder and CEO of tell.money commented, “With the deadline approaching on the 31st of October, tell.money stands ready to assist firms in becoming compliant. We are proud to offer a customer-centric solution that ensures implementing protection against fraud and misdirected payments is no longer a burden for firms. Our goal is to make compliance easy, ensuring PSPs can seamlessly integrate into the open banking ecosystem while safeguarding the interests of their customers.”

As a key integration choice for financial services providers looking for compliance, tell.money is committed to supporting businesses and enabling account providers to seamlessly integrate into the open banking ecosystem.

David Monty further added, “tell.money is here to turn the odds in favour of businesses. Our mission is not just about compliance, but also inclusion and accessibility. That’s why our technological solution is simple to use while still being comprehensive and effective.”

For more information about tell.money visit https://tell.money/

About tell.money:

tell.money is a leading financial technology company dedicated to simplifying financial and compliance processes for businesses. With a customer-centric approach and a focus on enabling inclusion, tell.money aims to provide industry-leading solutions to protect against fraud and misdirected payments, while seamlessly integrating with the open banking ecosystem.

tell.money serves Account Providers, Third third-party providers, and Account Holders through a dedicated and fully compliant cloud-based API Gateway that is fast, scalable, resilient and instantly actionable.