How to achieve the UK’s top 10 financial new year’s resolutions as 1 in 10 can only last a week

With 2023 just days away, people across the UK are starting to plan their new year’s resolutions, but which are the most popular and how can they be achieved?

Experts at Zuto Car Finance have surveyed Brits [1] to determine their top ten financial goals of 2023, after 40% claimed they are worried about their money next year. 37% want to be financially stable during the cost-of-living crisis and 20% claim their spending is out of hand.

How long do people usually stick to their new year’s resolutions?

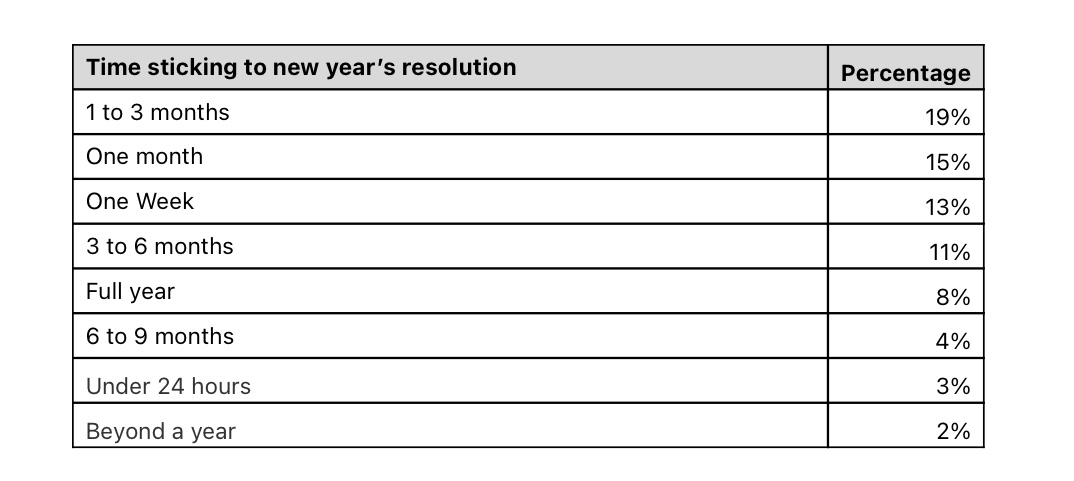

As one in five (19%) can only stick to a new year’s resolution for one-three months of year, Zuto has analysed each of the top ten resolutions and provided expertise on how to realistically achieve each goal.

Worryingly, 3% of Brits can’t even last a single day, whilst just 2% make the full year:

What are the top 10 financial new year’s resolutions for 2023?

The most popular aim for Brits is setting a savings goal and achieving it, with 42% of people picking this to try in the new year.

Others are focusing on their bad credit scores, with (16%) looking to improve it and 11% pledging to check it more often.

A third (31%) plan to stop frivolous spending, whilst one in five (19%) want to concentrate on paying their bills comfortably.

When questioned why they can’t complete their new year’s resolutions, a third (34%) of Brits admitted they have a lack of self-control and 16% claim that not planning properly ruins their chances of succeeding.

For the best chance of sticking to any of the top financial new year’s resolutions, see Zuto’s combined resolution guidance on how to achieve them below,

1. Setting a savings goal and achieving it

Focus on setting a savings goal that works for you. To see what’s reasonable, start by tracking what you spend on average in a month, and work what your essential outgoings are. That could mean rent, gas and electric bills, monthly car payments, travel costs or anything else that you’ll need to budget for regularly. When you know what your essential monthly outgoings are, you’ll know how much you’ll be left with, and from there you can set a sensible amount to put into your savings each month while still making sure the essentials are covered.

2. Stopping frivolous spending

When buying anything, the first thing you should be asking yourself is whether or not you actually need what you’re about to buy. If the answer is no, then put it down and walk away. This can be tricky, but once you get used to it, you’ll find your spending habits starting to change naturally.

Take a look at all your current subscriptions and cancel any that you don’t use or need. You can also unsubscribe from marketing emails to remove the temptation of browsing new offers, and leave credit and debit cards at home if you don’t need to shop while out.

3. Improving a bad credit score

If saving isn’t the issue but you do find yourself in need of financing for certain large purchases, then you likely know how important your credit score is for getting a good deal. To improve a credit score,

As for the goal of checking your credit score more, you can actually check your score as often as you like with no negative impact. Simply reach out to one of the main credit reference agencies, TransUnion, Equifax, or Experian, and they’ll be able to help you.

4. Paying off your debts

Target any debts you have with high interest rates. Interest means you pay more, so getting these debts resolved first can help to save you money in the long run. It might take a while to sort out if you’ve got a lot of different debts, but as a bonus, clearing your debts can help to boost your credit score as well as help you save.

If paying off your debts is going to be tricky for you in the new year, consider looking at refinancing options for your credit products. Switching to a longer payment term can help to reduce your monthly payments, or check to see if you’re now eligible for a lower rate.

5. Paying your bills

Much of the advice we can offer relates to spending less and prioritising your bills alongside other essentials, including focusing on the previous tips we’ve mentioned.

Unfortunately, the hard truth is that by meeting your bills, you will most likely be forced to sacrifice other luxuries, though this is more than worth it in the long run as you’ll avoid getting into unnecessary debt by missing bill payments.

6. Being financially comfortable

Last, but not least, if you have the goal of being financially comfortable in the New year, and as with meeting your bills, this all comes down to how you approach saving and spending.

In many cases, by following the advice we’ve outlined above, you’ll find your financial situation stabilising, though it might take longer than a year before you find yourself in a position of being financially comfortable.

Lucy Sherliker, Head of Customer at Zuto commented on the data: “With the current cost of living crisis and one of the worst recessions on record, staying with new year’s resolutions isn’t feasible for many. However, we hope our guidance can give Brits a better chance of seeing it through, and having a more comfortable 2023. For further helpful information relating to finance and credit, you can visit https://www.zuto.com/blog/”