How to ensure your child doesn’t become a victim of the cost-of-living crisis

Students across the UK are facing the most challenging back-to-school period, transitioning back to the classroom following a pandemic resulting in halted learning and amid a spiralling cost-of-living crisis. Yet parents, in particular, are feeling the pressure, with data unveiling that nearly half of UK parents are struggling to pay their bills and four out of ten families with school-age children have been forced to cut back on food. Now, as the cost of everyday essentials rises faster than ever, parent’s may be seeking creative ways to ensure that their children don’t face the brunt of the cost-of-living crisis. Yet despite parents having to face cutbacks in all areas of their lives, a study by MyTutor found that 62% say their child’s education will not be on the list of cutbacks. With this in mind, MyTutor, the UK’s most trusted tutoring platform, unveils their top tips to making sure your child’s wellbeing and education don’t slip.

Work out creative ways to cut costs together

With the weather getting colder and people having to cut back on their energy bills by turning off the lights and keeping the radiator on standby, you can create fun ways to cut costs by having team challenges to see who can save the most energy. Make it a challenge for your kids to turn off the lights, you could make warm blanket forts, and have rewards for green behaviour to save costs – it will also make your kids excited about saving money and foster energy efficiency at a young age.

Source free online learning resources to make sure their education isn’t impacted by the cost-of-living crisis

MyTutor is launching their ‘MyTutor Squads’ for students looking for free interactive learning resources on the subjects that students are struggling the most with. Offering free online tutoring sessions in Maths, Coding, and Smart Study Habits, MyTutor is proof that a well-rounded education that sets your child up for success, doesn’t need to cost an arm and a leg. ‘MyTutor Squads’ start 10 October and run until 16th December, for all students seeking extra support free online tutoring classes throughout the autumn term.

Subjects:

Maths GCSE (MyTutor Maths Squad) – every Monday at 5pm from 10 October

Study Skills (MyTutor Study Squad) – every Thursday at 5pm from 13 October

Coding (MyTutor Coding Squad) – every Tuesday at 5pm from 11 October

Talk to your child about the cost-of-living crisis

With the cost-of-living crisis creeping into every nook and cranny of how we live our lives, your children are bound to pick up on any anxiety that you may be feeling. Don’t be afraid to talk to your child about the costs rising and that some things in their lives may have to be adjusted because of the financial strain you are under. Be honest and direct when explaining that you may not be able to afford everything that you were able to before, and make sure you stay stern and don’t give into ‘pester power’. Being honest with them about money will teach them at a young age to be responsible with something that they will be dealing with for the rest of their adult lives.

Help your child learn about budgeting and sort out what matters to them

When you speak to your child open and honestly about what you are doing to mediate costs, you can also take the opportunity to teach your child about managing their own money in a smart way. If they have an allowance, teach them to make sure to put some of it away, or sort out with them what is important to them, like spending money for a trip away, or a video game that they have their eye on. Teaching them that practicing good habits with money will stick with them throughout their whole lives, while learning the value of working for what they do make.

Set them up with the tools to budget themselves

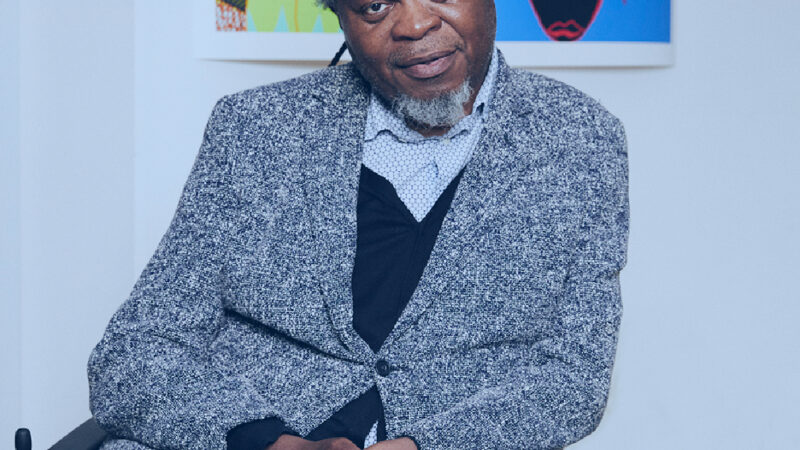

New research from money management app HyperJar, has found that a staggering 45% of British parents believe their children will have a much tougher time financially than they have experienced. In light of this, HyperJar CEO and Founder, Mat Megens, stresses the importance of teaching children saving and budgeting skills from a young age, and giving them the necessary responsibility to do so.

With HyperJar’s specialised pre-paid Kids Card, any potential dangers surrounding kids having their own debit cards are mitigated whilst empowering children to build autonomy over their money management from a young age. Firstly, the card is controlled by parents in their own HyperJar app, enabling them to top up any given amount, set spending limits, monitor transactions and even limit where money can be spent to certain retailers.

Children also have their own version of the app, enabling them to have a real-time view of their spending. Their pocket money can also be segmented into any number of digital ‘Jars’, teaching them how to budget and save for various outgoings from an early age. Whilst most standard banks only offer kids’ cards from the age of 11 and above, HyperJar’s unique offering is available for children aged 6 plus. Crucially, for cash-strapped parents amidst the cost-of-living crisis, HyperJar’s Kids Card is completely free to order and use.